The Top Features to Look for in a Secured Credit Card Singapore

The Top Features to Look for in a Secured Credit Card Singapore

Blog Article

Exploring Options: Can Former Bankrupts Secure Credit History Cards Adhering To Discharge?

One common question that emerges is whether previous bankrupts can successfully obtain credit history cards after their discharge. The answer to this questions entails a complex expedition of different elements, from credit score card alternatives customized to this market to the influence of previous financial choices on future creditworthiness.

Understanding Credit Scores Card Options

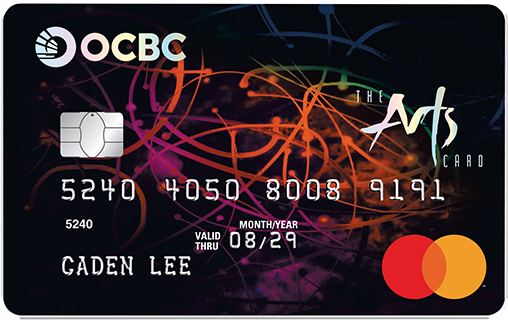

When considering credit score cards post-bankruptcy, individuals should meticulously evaluate their demands and financial circumstance to choose the most ideal alternative. Secured credit report cards, for instance, require a money down payment as collateral, making them a practical option for those looking to reconstruct their credit history.

In addition, individuals should pay close focus to the annual percentage rate (APR), moratorium, yearly charges, and benefits programs used by various charge card. APR determines the price of obtaining if the equilibrium is not paid completely monthly, while the elegance duration establishes the window throughout which one can pay the equilibrium without sustaining passion. In addition, yearly costs can influence the general expense of having a charge card, so it is essential to assess whether the benefits outweigh the fees. By thoroughly reviewing these variables, people can make informed choices when picking a credit rating card that aligns with their financial objectives and conditions.

Elements Affecting Approval

When applying for credit rating cards post-bankruptcy, understanding the factors that impact approval is important for individuals seeking to rebuild their economic standing. Adhering to an insolvency, credit report scores frequently take a hit, making it tougher to certify for standard credit score cards. Showing accountable monetary habits post-bankruptcy, such as paying bills on time and maintaining credit rating utilization reduced, can likewise positively influence credit card authorization.

Protected Vs. Unsecured Cards

Protected credit score cards need a cash deposit as collateral, normally equivalent to the credit scores limitation expanded by the issuer. These cards usually provide higher credit scores limitations and reduced interest rates for individuals with great credit score ratings. Inevitably, the option between safeguarded and unprotected credit resource score cards depends on the person's financial situation and credit report goals.

Building Credit Properly

To properly rebuild credit report post-bankruptcy, developing a pattern of responsible credit score utilization is vital. One key method to do this is by making timely payments on all credit report accounts. Settlement history is a significant consider establishing credit rating, so making certain that all bills are paid on schedule can progressively boost credit reliability. Additionally, keeping charge card balances low about the credit line can positively affect credit history. secured credit card over at this website singapore. Professionals suggest keeping credit report utilization below 30% to demonstrate responsible credit scores administration.

Another approach for developing credit scores sensibly is to keep an eye on credit rating reports consistently. By examining debt reports for mistakes or signs of identity theft, individuals can address issues promptly and maintain the accuracy of their credit scores background.

Gaining Long-Term Advantages

Having established a foundation of accountable credit score monitoring post-bankruptcy, individuals can currently concentrate on leveraging their enhanced credit reliability for long-lasting economic advantages. By consistently making on-time repayments, maintaining credit history usage reduced, and monitoring their credit report reports for accuracy, former bankrupts can slowly restore their credit history. As their credit report raise, they might end up being eligible for far better credit scores card provides with reduced passion rates and higher credit restrictions.

Gaining lasting benefits from improved credit reliability prolongs past simply credit report cards. Furthermore, a positive credit score account can enhance job potential customers, as some employers might check credit records as part of the employing process.

Verdict

To conclude, previous insolvent people might have problem protecting debt cards complying with discharge, but there are alternatives readily available to aid reconstruct credit report. Comprehending the different kinds of bank card, aspects influencing authorization, and the importance of responsible charge card use can assist people in this scenario. By picking the appropriate card and utilizing it properly, former bankrupts can slowly enhance their credit report and enjoy the long-lasting benefits of having accessibility to credit report.

Showing accountable financial actions post-bankruptcy, such as paying expenses on time and maintaining credit scores utilization reduced, can likewise positively affect credit report card authorization. Additionally, keeping credit report card balances reduced relative to the debt limitation can favorably influence credit history scores. By constantly making on-time repayments, keeping credit scores utilization reduced, and monitoring their credit rating records you can try here for precision, previous bankrupts can progressively restore their credit report scores. As their debt ratings increase, they might become qualified for much better credit score card provides with reduced passion rates and higher credit score limitations.

Recognizing the different types of debt cards, elements impacting authorization, and the importance of accountable credit scores card usage can help people in this circumstance. secured credit card singapore.

Report this page